What Happens After Your Roof Claim Is Approved (Georgia) + How to Choose a Contractor

This page explains the “next steps” after approval: payments, depreciation, supplements, timing, and a simple contractor selection checklist — in plain English.

Keep this page linked from your claim hub so homeowners don’t get stuck after approval.

Post-approval anxiety usually causes rushed decisions: signing with the wrong contractor, misunderstanding depreciation, or missing paperwork that delays the final payment.

1) What “approved” really means

When a roof claim is “approved,” it usually means the insurer has:

- Accepted a cause of loss (wind/hail/tree, etc.)

- Agreed to a repair or replacement scope (sometimes partial at first)

- Issued an estimate and payment (often not the full amount yet)

2) How payments usually work (ACV vs RCV)

Many Georgia policies pay in stages:

- ACV (Actual Cash Value) is paid first (this is the “today” payment).

- RCV (Replacement Cost Value) is the full cost to restore, which may include amounts released later.

In practical terms, homeowners often see:

- Initial check (often ACV)

- Mortgage company endorsement process (if applicable)

- Final amounts released after completion documents are submitted

3) Recoverable depreciation (how you get the rest)

Depreciation is commonly “held back” until work is completed. To release recoverable depreciation, insurers usually require some combination of:

- Final invoice

- Certificate of completion (or similar)

- Photos of completed work

- Proof of payment / contractor agreement (varies by carrier/policy)

4) Supplements after approval (when and why)

Supplements can happen even after a claim is approved. Common reasons include:

- Code-required items confirmed during permitting

- Missing roof system items (flashing, ventilation, accessories)

- Steep/high complexity charges not included initially

- Hidden but legitimate scope discovered during tear-off

A supplement should be evidence-based and written in estimating language (not emotional language).

5) How long this usually takes (and what slows it down)

Timing varies by carrier, mortgage involvement, weather, and contractor availability, but delays usually come from:

- Mortgage endorsement steps (two-party checks)

- Incomplete documentation for depreciation release

- Permit/code verification delays

- Scope mismatches discovered late (because the original inspection wasn’t thorough)

- Contractor scheduling and material lead times

6) How to choose the right contractor (Georgia checklist)

After approval, contractor selection is where homeowners most often get burned. Use this checklist before signing anything:

The “Evidence + Process” Checklist

- Scope clarity: Do they explain scope vs estimate and show what’s included (and what isn’t) in writing?

- Documentation ability: Can they produce clean photos, measurements, and line-item justification if the claim needs a supplement?

- Code awareness: Do they understand permitting and code/ordinance impacts in your area?

- Payment flow: Can they explain ACV/RCV and depreciation release without guessing?

- Change control: Do they have a defined process for change orders and supplements (so you’re not surprised later)?

- Workmanship warranty: Is it written and meaningful (not vague marketing)?

- Insurance familiarity without “games”: Do they speak estimating language without acting adversarial?

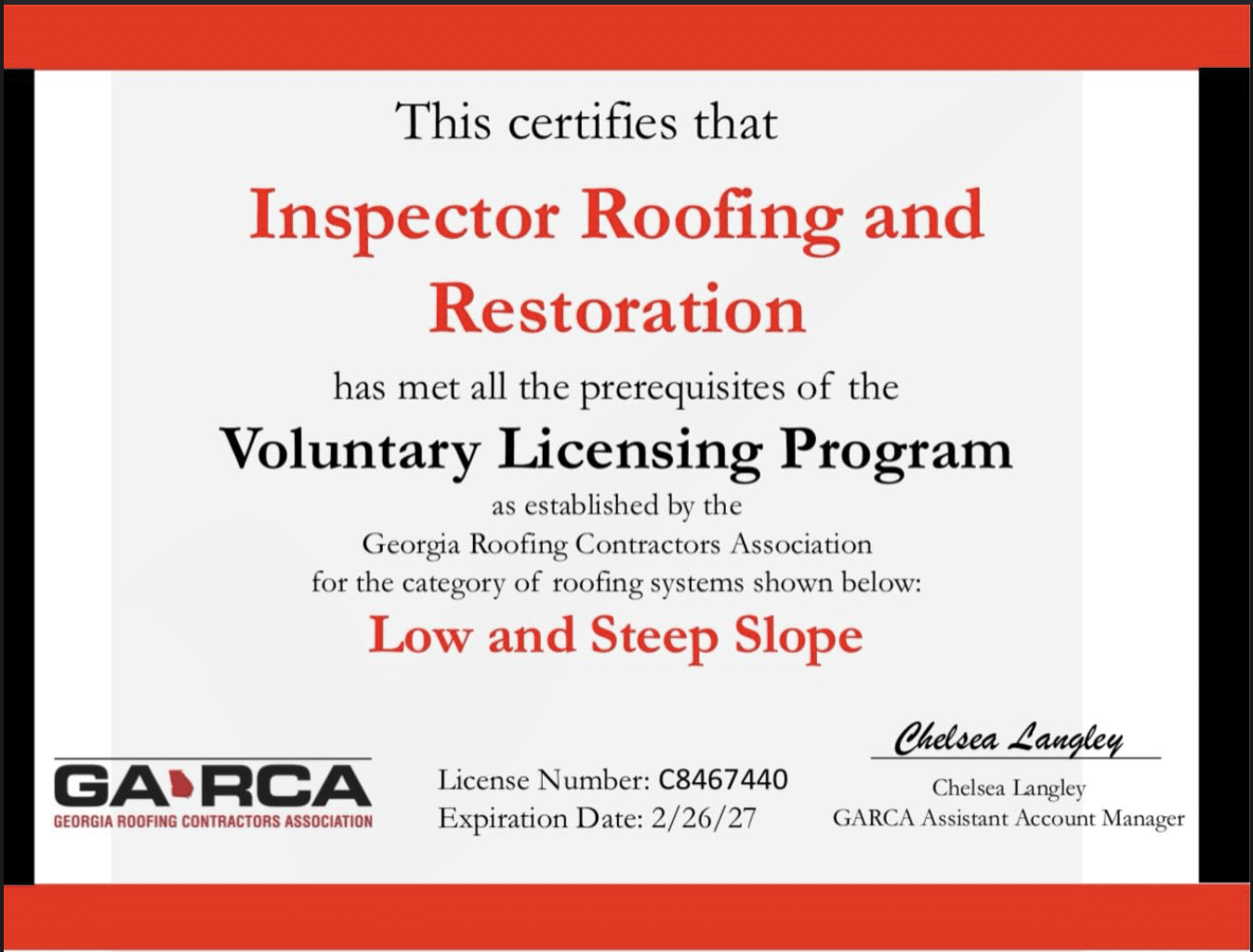

- Local accountability: Are they established locally with verifiable presence (not storm-chasing only)?

Questions to ask (copy/paste)

- “Can you show me your scope in writing and how it matches (or differs from) the insurance scope?”

- “If something is missing, how do you document and submit it?”

- “What documents does my carrier usually require to release depreciation?”

- “What happens if the roof deck or flashing requires additional work during tear-off?”

- “Who is my day-to-day contact during the build?”

7) Red flags to avoid

- “Don’t worry about paperwork, we’ll handle everything” (without explaining how)

- High-pressure “sign today” tactics

- No written scope, or a scope that changes constantly without explanation

- Vague warranty language

- Refusal to discuss how depreciation works

- Contract language that feels unclear or one-sided

FAQs

Do I have to use the contractor my insurance recommends?

Usually, no. Homeowners typically have the right to choose their contractor. The most important factor is that the contractor can execute the approved scope correctly and handle documentation if scope changes.

What if my contractor’s scope is higher than the approval?

That’s common. It may mean the original scope is incomplete. The correct pathway is evidence-based documentation and a supplement request (when justified).

When do I get the recoverable depreciation?

After the work is completed and the required closeout documents are submitted, per your policy terms. Your contractor should help you package completion documentation cleanly.

Will a supplement delay my job?

Not always. Good contractors can document and submit supplements quickly, especially when the scope gap is discovered early (before or at tear-off).