Why Roof Claim Documentation Matters

Insurance claims are documentation-driven. Adjusters rely on photos, timelines, and physical evidence to determine whether damage is storm-related, pre-existing, or excluded under policy terms. Incomplete or inconsistent documentation is one of the most common reasons valid claims stall or underpay.

Proper documentation does not mean exaggeration. It means clarity. When damage is clearly documented, adjusters can focus on evaluation rather than investigation. This often results in faster decisions and fewer disputes.

Step 1: Prepare Before You Take Photos

Preparation takes only a few minutes but prevents confusion later. Before documenting anything, create a dedicated folder on your phone or cloud storage labeled with your address and the storm date.

- Enable timestamps and location data on your camera.

- Do not edit or apply filters to photos.

- Use natural lighting whenever possible.

- Keep all documentation for a single storm in one folder.

Step 2: Exterior Property Documentation

Start wide and work inward. Adjusters need context before they evaluate details.

Property Overview

- House number, mailbox, or street sign

- All four sides of the home

- Roof slopes photographed from ground level

Collateral Damage

Collateral damage is often the strongest evidence of hail or wind. It helps establish storm intensity even when roof damage is subtle.

- Gutters, downspouts, and drip edge

- Window screens and trim

- Roof vents, skylights, flashing

- AC condenser fins and soft metals

Step 3: Roof Surface Documentation

Only access the roof if conditions are safe. Wet slopes, steep pitches, or fragile materials present serious fall risks.

- Missing, creased, or lifted shingles

- Hail impact marks or bruising

- Damaged pipe boots and flashing

- Exposed fasteners or seal failures

Step 4: Interior and Attic Evidence

Interior damage supports roof claims by showing the functional impact of exterior damage.

- Ceiling stains or bubbling drywall

- Active leaks or water trails

- Damaged insulation or roof decking (if accessible)

- Exact room and location notes

Step 5: Timeline and Written Notes

Written documentation provides context photos cannot. Keep notes factual, concise, and consistent.

- Date and approximate time of storm

- Observed weather conditions

- When damage or leaks were first noticed

- Temporary mitigation performed

Step 6: Temporary Repairs and Receipts

Insurance policies require homeowners to prevent further damage. Temporary repairs are allowed and encouraged, but they must be documented.

- Photograph damage before repairs

- Photograph mitigation after completion

- Save receipts for materials or services

Common Claim Mistakes to Avoid

- Delaying mitigation on active leaks

- Throwing away damaged materials too soon

- Combining multiple storm events

- Signing unclear or high-pressure agreements

- Allowing unqualified parties to control claim documentation

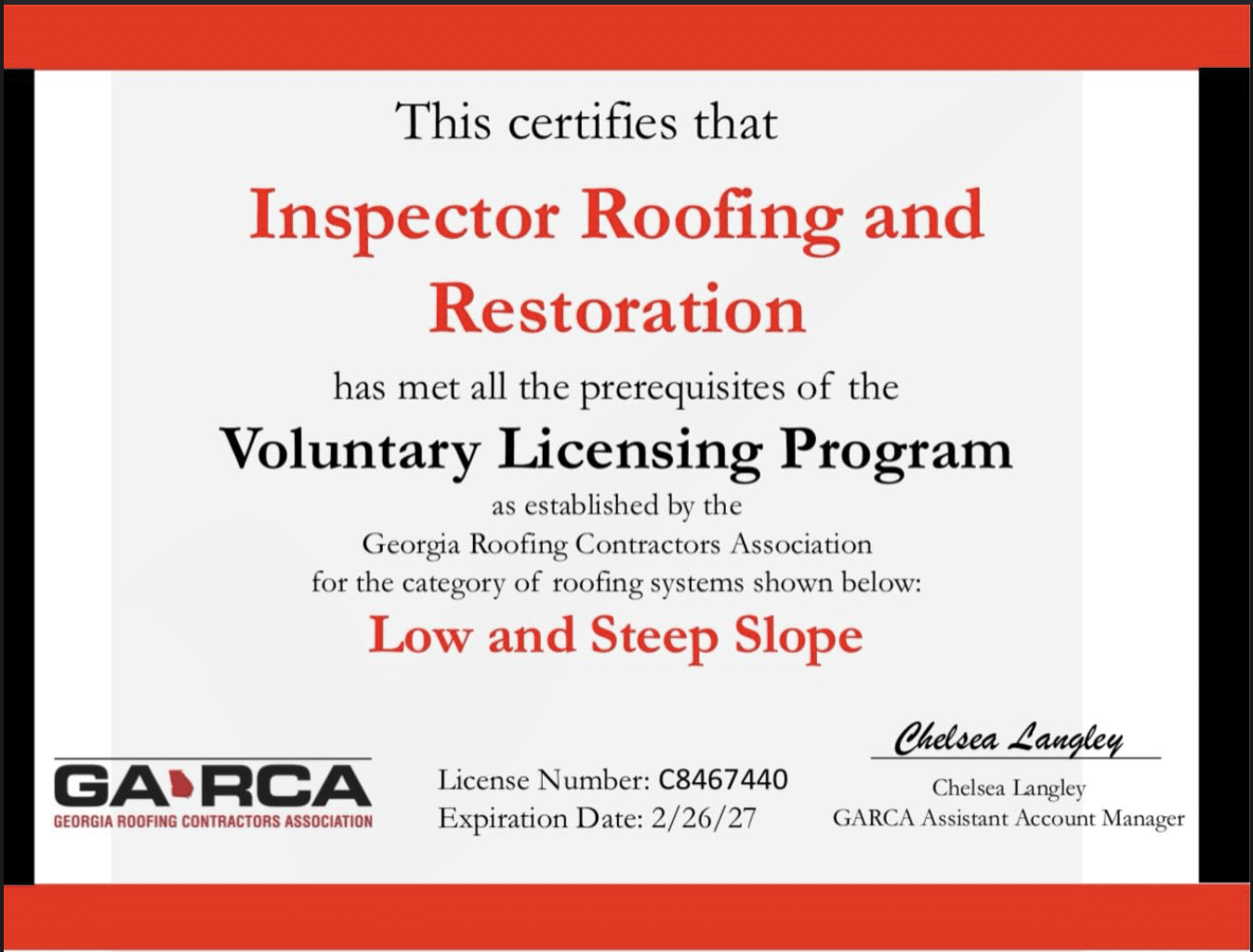

Professional Inspection Documentation

A professional inspection bridges the gap between homeowner documentation and adjuster evaluation.

- Photos labeled by slope and location

- Wind and hail indicators explained

- Collateral damage correlation

- Repair vs replacement recommendations

Frequently Asked Questions

How many photos should I take?

Most claims benefit from 30–60 well-organized photos showing context, collateral, and interior evidence.

Should I file a claim before an inspection?

You can, but inspection-backed documentation often prevents disputes and supplements later.

Can I repair my roof before the adjuster arrives?

Temporary repairs are allowed to prevent further damage, but permanent repairs should wait when possible.

What if damage is not obvious?

Subtle damage is common. Collateral evidence and professional inspections help establish storm impact.

Does documentation guarantee claim approval?

No, coverage depends on policy terms. Documentation ensures damage is evaluated accurately and fairly.